Public sector banks accounted for over 85% of total frauds

reported in the banking system in 2017-18, according to the RBI’s financial

stability report (FSR). The banking system reported 6,500 frauds, amounting to

more than ₹30,000 crore.

Yes, in 2018

we are getting to learn how poor the PSU banks are regulated, pathetic internal

controls, poor IT infra, and least to say the this raises serious questions on

how these banks are governaned?

The NPA mess is the biggest scam that the UPA Government has given

in legacy to the NDA .

Indian Banking sector, especially the state-owned banking segment,

is under severe stress with mounting bad loans and an increase in bank fraud,

among other issues. More than half of the listed state owned banks that account

for about 20% of overall system advances are already under Prompt Corrective

Action (PCA) framework, and a few more are expected join the list soon.

The

non-performing assets (NPA) situation in the banking sector is alarming. At

least 15.8% of the total loans in the banking sector are tagged under the

stressed asset category. The nudge from RBI to clean up the system has shown

the actual depth of the trouble on the books of Indian banks (hidden bad

loans).

State-owned

banks have already reported record level of bad loans resulting in huge

cumulative losses of about Rs.55,000 crore in financial year (FY) 18 (reported

thus far). Recent capital infusion of about Rs.88,000 crore was too little and

too late.

The

passage of the bankruptcy law was definitely a major step in the process of

overhauling the banking sector. But the task is half-done yet. It needs to be

well-supported by other comprehensive reforms in the sector such as adding more

judicial muscle to NCLT; incentivizing faster resolution of NPAs through ARCs;

reviewing ownership, control and governance issues of state-owned banks in the

long run.

Bashing our banks, particularly the government-owned ones, which

roughly have 70% market share of assets, has become a favourite pastime for

many. Instead of going deep into the causes of deterioration in health and the

possible remedies, let’s focus on some of the vital statistics to get a sense

of the state of affairs in the ₹150 trillion

banking system in the world’s fastest

growing large economy.

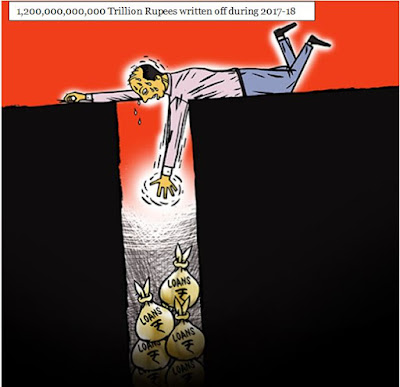

Public sector banks (PSU banks) have

written off non-performing assets (NPAs) worth Rs1.20 trillion, an amount that

is nearly one-and-a-half times more than their total losses posted in 2017-18,

according to official data. This is the first time in a decade that banks have

made huge write-offs on bad loans while booking hefty losses.

A write-off means that the bank has

made 100% provision from its earning against that account. This NPA is no

longer part of the bank’s balance sheet.

The

Table below gives the broader picture of the Gross and Net NPA of PSU and Pvt

Banks. (Data taken from official RBI site) (Amount in Millions)

NATIONALISED

BANKS

|

Gross NPA

|

Net NPAs

|

Bank

|

As on March 31 2017

|

Write-off during the Year

|

As on March 31 2018

|

As on March 31 2017

|

As on March 31 2018

|

STATE BANK OF INDIA & ITS ASSOCIATES

|

1219686

|

278388

|

1778106

|

688944

|

969322

|

ALLAHABAD BANK

|

153846

|

24421

|

206878

|

102925

|

134335

|

ANDHRA BANK

|

114436

|

16231

|

176700

|

60357

|

103548

|

BANK OF BARODA

|

405210

|

45156

|

427187

|

194065

|

180802

|

BANK OF INDIA

|

498791

|

72306

|

520445

|

279964

|

253050

|

BANK OF MAHARASHTRA

|

103859

|

13571

|

171887

|

69193

|

112296

|

BHARATIYA MAHILA BANK LTD.

|

14

|

-

|

550

|

7

|

462

|

CANARA BANK

|

316378

|

55448

|

342020

|

208329

|

216490

|

CENTRAL BANK OF INDIA

|

227210

|

23960

|

272510

|

132420

|

142180

|

CORPORATION BANK

|

145443

|

35737

|

170452

|

91601

|

116922

|

DENA BANK

|

85605

|

8334

|

126187

|

52305

|

77351

|

IDBI BANK LIMITED

|

248751

|

28682

|

447526

|

146434

|

252058

|

INDIAN BANK

|

88270

|

12254

|

98651

|

54194

|

56066

|

INDIAN OVERSEAS BANK

|

300486

|

29540

|

350983

|

192126

|

197493

|

ORIENTAL BANK OF COMMERCE

|

147018

|

23083

|

228593

|

99322

|

141178

|

PUNJAB AND SIND BANK

|

42291

|

4906

|

62976

|

29495

|

43751

|

PUNJAB NATIONAL BANK

|

558183

|

92051

|

553705

|

354226

|

327021

|

SYNDICATE BANK

|

138322

|

12707

|

176093

|

90149

|

104110

|

UCO BANK

|

209077

|

19339

|

225410

|

114436

|

107034

|

UNION BANK OF INDIA

|

241709

|

12637

|

337123

|

140259

|

188321

|

UNITED BANK OF INDIA

|

94710

|

7137

|

109520

|

61107

|

65919

|

VIJAYA BANK

|

60271

|

10683

|

63818

|

42768

|

41182

|

NATIONALISED BANKS

|

4179879

|

548183

|

5069213

|

2515681

|

2861567

|

PRIVATE

SECTOR BANKS

|

Gross NPA

|

Net NPAs

|

Bank

|

As on March 31 2017

|

Write-off during the Year

|

As on March 31 2018

|

As on March 31 2017

|

As on March 31 2018

|

AXIS BANK LIMITED

|

60875

|

22221

|

212805

|

25221

|

86266

|

BANDHAN BANK LIMITED

|

188

|

312

|

863

|

102

|

612

|

CATHOLIC SYRIAN BANK LTD

|

4469

|

1393

|

6001

|

3452

|

4476

|

CITY UNION BANK LIMITED

|

5120

|

1635

|

6820

|

3232

|

4083

|

DCB BANK LIMITED

|

1974

|

444

|

2542

|

975

|

1244

|

FEDERAL BANK LTD

|

16678

|

2364

|

17271

|

9500

|

9412

|

HDFC BANK LTD.

|

43928

|

23859

|

58857

|

13204

|

18440

|

ICICI BANK LIMITED

|

262213

|

121919

|

421594

|

129631

|

252168

|

IDFC BANK LIMITED

|

30583

|

0

|

15421

|

11390

|

5765

|

INDUSIND BANK LTD

|

7768

|

4655

|

10549

|

3218

|

4389

|

JAMMU & KASHMIR BANK LTD

|

43686

|

8570

|

60000

|

21640

|

24254

|

KARNATAKA BANK LTD

|

11804

|

4580

|

15816

|

7955

|

9747

|

KARUR VYSYA BANK LTD

|

5112

|

2638

|

14838

|

2162

|

10335

|

KOTAK MAHINDRA BANK LTD.

|

28381

|

4223

|

35786

|

12620

|

17181

|

LAKSHMI VILAS BANK LTD

|

3913

|

915

|

6402

|

2316

|

4184

|

NAINITAL BANK LTD

|

1210

|

6

|

1643

|

277

|

395

|

RBL BANK LIMITED

|

2081

|

687

|

3568

|

1244

|

1899

|

SOUTH INDIAN BANK LTD

|

15624

|

738

|

11490

|

11853

|

6746

|

TAMILNAD MERCANTILE BANK LTD

|

4189

|

2438

|

6486

|

2007

|

3819

|

THE DHANALAKSHMI BANK LTD

|

4589

|

1890

|

3156

|

1932

|

1665

|

YES BANK LTD.

|

7490

|

1421

|

20186

|

2845

|

10723

|

PRIVATE SECTOR BANKS

|

561874

|

206907

|

932092

|

266774

|

477802

|

Till

1969, the State Bank of India (SBI) was the only bank that was not privately

owned. It was called the Imperial Bank before its nationalisation in 1955. There

were primarily two reasons why the ownership of these 14 banks was transferred

to the government. The first was the unpredictable manner in which these

functioned as private entities.As this report in The Economic Times points out,

there were 361 private banks which "failed" across the country in the

period from 1947 to 1955, translating to an average of over 40 banks per year.

More often than not, this resulted in depositors losing all their money as they

were not offered any guarantee by their respective banks.

Second,

these commercial banks were seen as catering to the large industries and

businesses. Agriculture, as a sector, was largely ignored by these banks

So

What Benefits Did Bank Nationalisation Promise? In 1969 only depositors lost

money in 2018 tax payers money is literally flushed down the drain by these so

called Nationalised bank.

In

light of these circumstances, the stated motive of this measure was to make

credit availability easy for what was called the “priority sector” –

constituting agriculture, small industries, traders and entrepreneurs. Moreover,

the focus was also on opening up of bank branches in the rural and backward

areas.

Even

as frauds and murky dealings continue to tumble out of the closets of the

biggest names in Indian banking, there is danger in assuming that the problem

is restricted to that industry.

India’s banking crisis isn’t just

about the likes of Punjab National Bank, Bank of Maharashtra

or ICICI Bank Ltd. India’s corporate sector,

including some of its largest companies, is as much a part of the toxic

environment that is now unravelling before us.

There

are scores of reasons for the appalling performance of the banks some of the

prime reasons are

Political

appointments; Majority of the CMD, Directors

in the PSU were all political appointee who would open the bank treasure on one

phone call from the south block! How can

a scam of Nirav Modi go untraced for 4-5 years when there are 3-4 types of

audits which happen every year? Definitely one rouge manager in some branch of

Mumbai cannot pull off the scam of a millennium!

Corrupt

Finance Minister; P Chidambaram who now is running from one court to other

seeking bail for himself and his family members the moment he completes taking

pot shots at the Modi govt. This guy is was cheap and corrupt that he ordered

Canara Bank to change its logo and sign board and in turn he made a cut off the

total amount spent on money spent on doing the overhauling the signboard etc.

One can gage how the finance of the country were handled during UPA 1&2

Every Indian company, large and

small, has at some stage put pressure on bankers to bend the rules either for sanctioning

loans or changing the repayment terms. Even as we rail against the executives

and the boards of the banks for conniving with borrowers, let’s not forget who

they were conniving with and for what.

Whether it is Rotomac or Nirav Modi, the script remains unchanged. Banks

have always been a fertile ground for political and corporate patronage.There’s

nothing new about this. For decades, money in the banks has been treated as the

personal fiefdom of a few.

In the 1980s, there were the

notorious loan melas, where politicians doled out funds through

nationalized banks without bothering about basic hygiene factors. Often, even

the loan application forms would be filled by bank staffers.

Post 1991, with the onset of private

banking, it was expected that more care and caution would be exercised. But as

the Indian economy moved into high gear following a global surge in growth,

Indian companies suddenly acquired a voracious appetite for bank loans to fuel

their many ill-conceived investments.

Significantly, once the easy-money

regime changed, particularly after Raghuram Rajan turned the central bank’s

lens on the lending and provisioning practices of the banks, Indian companies’

appetite for investments also dried up.

It is one thing to plan ambitious

projects or large acquisitions with the reassuring backing of soft loans at

nominal rates of interest and flexible repayment terms and quite another to do

so on more stringent forms of financing.

The returns needed to service a bank

loan are different from those needed to service any other form of

financing.

Not surprisingly, after 2010, there

has been a decline in the share of gross capital formation (GCF) in GDP, from

38.2% to 32.3% between 2011–2012 and 2013–2014, with the corporate sector’s

contribution as GCF also

If

banks have failed to judge the creditworthiness of the companies they have lent

to or failed to detect those initial signs of stress before a loan turns

non-performing, it is in part because of the elaborate efforts companies make

to window dress their accounts.

When the chairman of Syndicate Bank

is arrested for taking a bribe from the promoters of Bhushan Steel, both are

equally culpable and deserve opprobrium.

But when Bhushan Steel becomes the

norm for corporate behaviour and a symbol of the manipulative power of our

largest companies, it is time to worry.

By cornering an abnormal share of

bank loans, large Indian companies have also created a canopy for themselves,

one under which more deserving and needy smaller businesses fail to grow for

want of credit.

Bad

loans at Indian banks, especially those controlled by the government, will

increase further in the year to 31 March, placing additional strain on the

already stressed financial system, a central bank study warned.

Gross non-performing asset (NPA)

ratio of banks will rise to 12.2% by March 2019 from 11.6% at the end of the

previous fiscal if economic conditions remain the same, said the Reserve Bank

of India (RBI) financial stability report.

The report said weak profitability

of banks is an additional concern as it prevents lenders from setting aside

adequate money to cover potential losses on loans and makes them vulnerable to

adverse shocks.

In a scenario of severe stress, this

ratio may rise to as high as 13.3% by March, the report said. For public sector

banks, this ratio may jump to 17.3% by March.

Rising bad loans will also lead to

further erosion of capital buffers. The capital adequacy ratio of banks will

drop to 12.8% by March 2019 from 13.5% at the end of the previous year. A

severe shock could, however, bring down the capital adequacy ratio of as many

as 20 banks, mostly state-run, below 9%, the report said.

Analysing the effectiveness of

prompt corrective action (PCA), the stability report said the gross NPA ratio

of state-run banks under PCA will worsen to 22.3% by March, with six banks

likely to experience capital shortfall under the baseline scenario.

Modi

Govt has a herculean task to tackle the NPA mess on one hand, fund the credit

demand, and manage the fiscal deficit without increasing market borrowing.

Raising taxes would make him unpopular in the election year. With the global

economy going through a slugging phase with rising trade wars between US and

China, Its India which is suffering as a collateral.

If

NaMo manages to pull off this banking mess and sets it in order, he would have

laid the foundation for a strong economic growth in the coming decade!